Credit Risk Management Automation

Automate large parts of the credit management process, including screening, customer acceptance, setting credit limits, data enrichment, monitoring and more.

Credit Risk Management Automation

What is credit risk management automation?

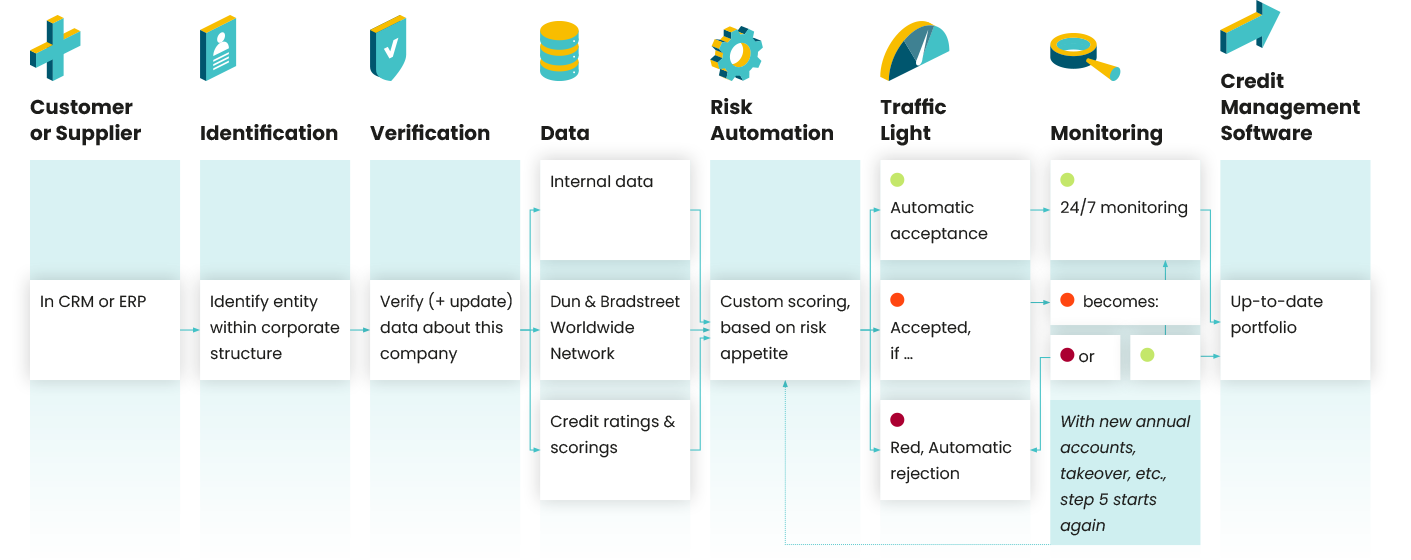

Credit Risk Management Automation creates one automated workflow for identifying, screening and monitoring customers and suppliers worldwide. Through custom scoring, customer segments can be assessed based on risk appetite and 24/7 monitoring ensures that you receive timely alerts on important changes in your portfolio.

API

Is your software not listed? Through our API we can create links with almost all credit management software.

Turnkey integrations with credit management software

Credit Management VS Credit Risk Automation

Automate your workflow, save costs, and get your credit process in sync with the rest of the organization.

Credit Management

Credit Risk Automation

EXPERIENCES

Our clients about Credit Risk Management Automation

"Our credit process is largely automated. It takes us relatively little time to screen relationships, which gives a big boost to our results."

What if I did not have any data and had delivered to a customer who is now bankrupt?” It is not possible to express in figures what this successful collaboration with Altares Dun & Bradstreet has yielded us."

"The alerts we receive when there are changes in a particular customer's situation mean additional time savings and a guarantee that we won't overlook important information."

The world's most versatile credit risk data

With insights into the financial health of 500+ million companies worldwide, Altares offers Dun & Bradstreet the world's most versatile credit risk data.

Overall Business Risk

The Overall Business Risk is a global risk score based on local data. Thus, it creates a global consistent view that can be used to compare companies in different countries.

Paydex

The Paydex is an analysis of millions of payments and payment experiences and shows how quickly a company pays its invoices. Every day we add thousands of payments for an up-to-date Paydex.

D&B Rating

The Dun & Bradstreet Rating has been considered the leading indicator of business risk for many years. The D&B Rating, which includes the "financial strength" (based on net equity) and the "risk factor" indicate how risky doing business with a particular company is.

Credit Limits

Recommended maximum credit that a creditor should have outstanding at one time. The limit is a calculation of company size, industry (SIC) and Risk Factor.

D&B Failure Score

This score refines the D&B Rating from 1 to 4 to a scale of 1 to 100. The higher the score, the healthier the company. Over the past thirty years, this score could predict some 80% of bankruptcies.

Corporate Linkages

Corporate Linkages unravels the relationships between companies within a corporate structure. We can do this thanks to the power of the D-U-N-S number; a unique 9-digit number for every corporate entity in the world.

Free consultation with a specialist

Discuss the possibilities for your unique situation with a specialist from Altares.

Get immediate answers about the opportunities within your workflow and organization.

Free. No strings attached.

"*" indicates required fields

Watch the webinar

AI en Credit Risk Management

In this webinar, our data scientist talks about how AI improves our scoring and ratings and what this means for credit management.

FAQ

For credit management software, there are integrations with: Highradius, Serrala, SOA-People and S4Dunning. For CRM, there are integrations with Dynamics, Salesforce and SAP. Through our API we can make integrations with almost all credit management software solutions.

We monitor our data 24/7 and update it daily. If there are changes, they are automatically implemented in your tools once every 24 hours. You can receive an alert of an impactful change, such as an adjusted credit rating of a customer.

The cost depends on the amount of data you purchase, such as the number of data points, in how many countries and the implementation. You will always receive a tailor-made price.

Whether you can create and implement our data and decision models yourself depends on the quality and knowledge of IT, data science and finance within your organization. We usually take care of the implementation, because organizations don't know the Dun & Bradstreet data well enough or don't have sufficient knowledge to program the model themselves. Large financial institutions, for example, generally take care of this themselves. We then only supply the data and advise on its use if necessary.

For a growing number of clients, Altares Dun & Bradstreet develops customized solutions for automatic client acceptance checks. In the case of customized scoring, for example, we draw up a personalized decision model based on a company's risk appetite. And for financial institutions and leasing companies we often develop predictive fraud indicators.