According to estimates, money laundering in the Netherlands alone involves around 13 billion euros every year. To combat these practices in Europe, the EU has introduced anti money laundering rules. The EU’s AML legislation has undergone a further update over the past year. AMLD6 will replace AMLD5. AMLD6 must be implemented in all EU member states by June 3, 2021.

The 6th AML Directive aims to establish European frameworks and introduce consistent, deterrent penalties for all member states.

From AMLD5 to AMLD6

Before we dive into the changes, let’s take a look back at AML5. We previously wrote an extensive article about AML5. The introduction of the UBO register, the stricter identification of UBOs and the broadening of the number of branches that must comply with the AML legislation were the main changes compared to AML4. Furthermore, we saw an increase in sanctions, something we also see in AML6.

The following matters will change after the implementation of the 6th AML Directive:

A new definition of “criminal activities”

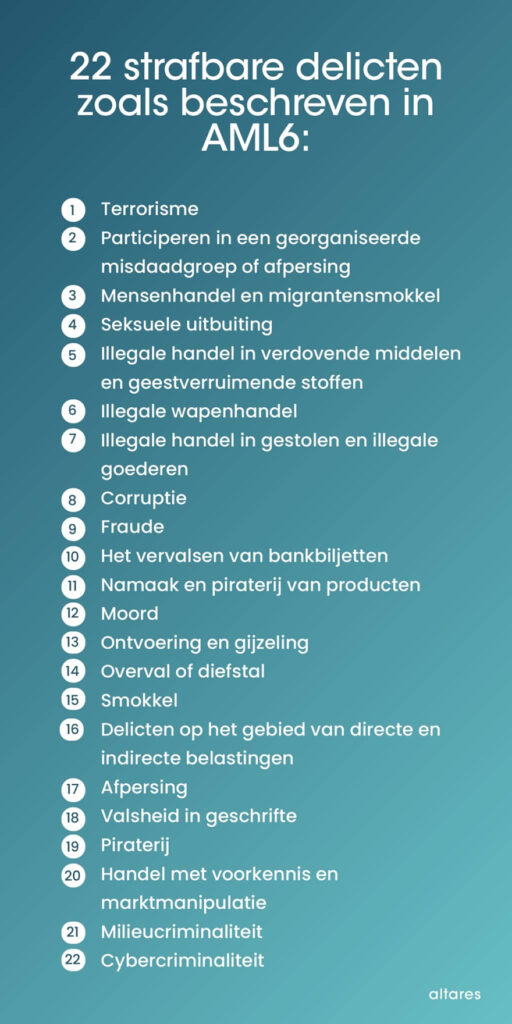

AMLD5 required all participating EU Member States to criminalize “criminal activities”. Under AMLD6, this concept is given further definition: the new Directive includes a list of predicate offences that must be criminalized by all EU Member States (if they were not already criminalized).

Criminalization of aiding and abetting

Another stricter rule under AMLD6 is that aiding and abetting, attempting, and inciting these offences must also be criminalized. Anyone who aids and abets in the situations listed above may be regarded as having committed money laundering practices, and may be subject to the same penalties as persons directly benefitting from money laundering practices.

Improved cooperation at the international level

Introducing the list of offences across all Member States will lead to a more consistent approach at the level of the EU overall. The European Union hopes that this will create greater uniformity and improve cooperation. Additionally, AMLD6 states that Member States that are involved in prosecuting an offence must cooperate with the aim of centralizing proceedings; the European Banking Authority (EBA) will coordinate this.

More severe sentences

Previously, Member States were free to decide for themselves what maximum sentences to attach to offences. Now, AMLD6 states that the maximum sentences must be at least 4 years. Additionally, the Member States may also impose new additional sanctions, such as fines, restrictions on grants, and even temporary disqualification from practicing commercial activities or holding government office.

Further scope for criminal liability

Besides additional penalties, the new rules provide further scope for holding legal entities liable under criminal law. Under the existing rules, only natural persons are punishable for money laundering; with the introduction of AMLD6, however, this criminal liability will be given added scope, and legal entities in the form of public and private limited liability companies will become punishable also.

How to ensure that your organization remains compliant

These new rules will mean added pressure for Compliance departments. For example, while AMLD6 is being implemented during the period ahead, organizations that are subject to the national implementations of the AML rules – including the Dutch Anti-Money Laundering and Anti-Terrorist Financing Act (Wwft) in the Netherlands – will be expected to scan their business relations and their UBOs for the 22 predicated offences that have been defined. Among other implications, this will involve reconsidering existing screening practices.

Altares Dun & Bradstreet: your data partner

Altares Dun & Bradstreet helps organizations create a corporate culture that prioritizes data as a strategic weapon. Our Dun & Bradstreet data cloudis an inexhaustible source of information, with insights that 90% of all fortune 500 companies access daily. Do you need help setting up a master data management strategy? Get in touch with us.