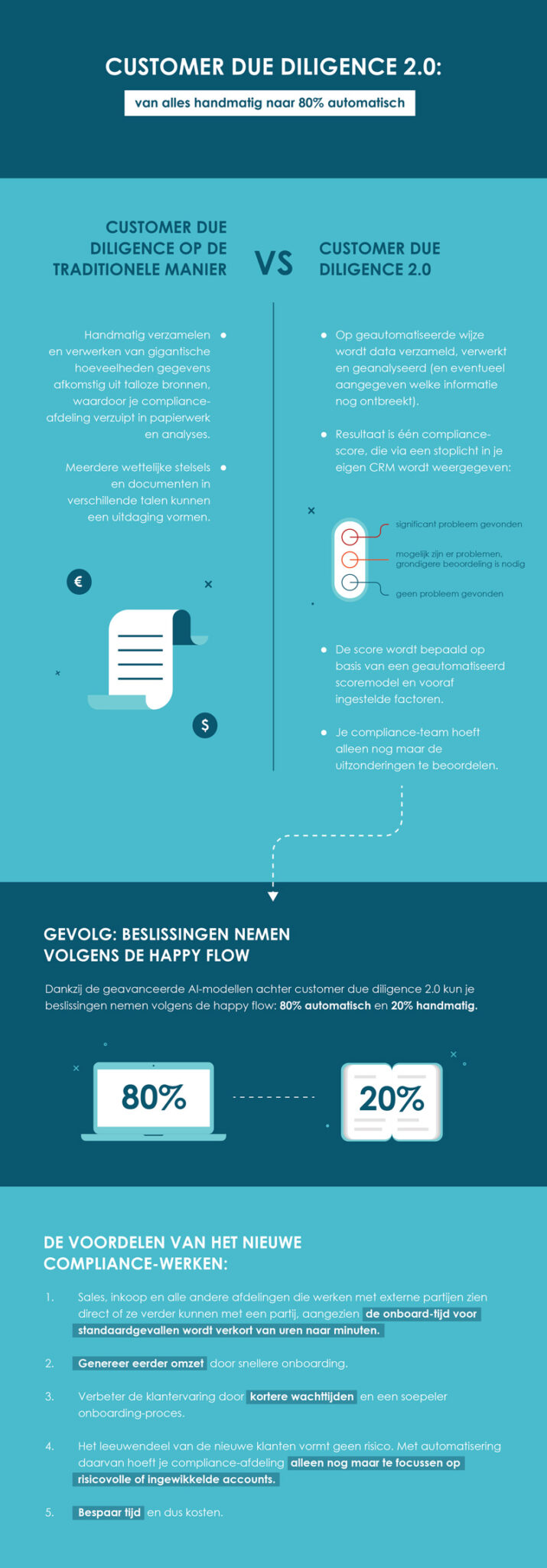

Manually collecting and processing massive amounts of data is inefficient and no longer necessary. Taking a different look at compliance and meeting requirements can save a lot of time and therefore costs with the help of automation. Manual decisions can be made on just the exceptions. 80% can be done thanks to advanced AI models. At Altares, we call this the Happy Flow.

Benefits of the new Compliance work is applicable to different departments. For example, the sales and purchasing department can easily screen third parties. And the compliance department can implement faster onboarding. And perhaps most importantly, the customer experience gets better because there is less and less waiting time! Read in this infographic how we use a scoring model to arrive at this Happy Flow .