Doing business has long ceased to be a matter of good faith. Especially with larger companies, the risks involved are just far too high. The alternative: running credit checks on (potential) customers before you close a deal. But how do you do that properly? The answer is certainly not straightforward. In fact, it largely depends on the size of your business (number of transactions) and the risk you run by order size. In this blog, we list the various possibilities.

Online

Ideal for: freelancers and small businesses that need an occasional credit report.

Good news: a small supplier is suddenly offered a mega-contract from an enterprise. If you want to take care of the catering for the coming year. Or keep the office dust-free for a year. However nice, such large contracts for small companies ensure that such a small supplier very quickly becomes very dependent on a single company for a large part of its annual turnover.

Do you need fully automated credit checks for that? Not really. Especially for these situations, we have a webshop waar je losse kredietrapporten kunt kopen. Zo kun je snel en relatief goedkoop kijken of je opdrachtgever de grote factuur kan betalen.

SaaS

Ideal for: companies that want to manually check more than 10 companies per year.

Do you need a larger number of credit checks per year? Then a SaaS solution is very convenient. For this, there's the platform called D&B Finance Analytics Je kunt hier alle kredietinformatie vinden die wij hebben over een bedrijf. Dat gaat een stuk verder dan alleen een rating. We kijken bijvoorbeeld naar de hele familiestructuur van een bedrijf, naar juridische activiteiten en je kunt automatische monitoring inschakelen voor belangrijke bedrijven. Verandert er iets in hun kredietstatus, dan krijg je daar automatisch een melding van.

Batch

Ideal for: companies that want to check the credit status of a large number of companies on a one-off basis.

Batch checking creditworthiness is a kind of health check on your customer portfolio. All the (potential) rotten apples within your customer base roll out automatically. The advantage of a batch is that you get quick and relatively cheap insight into your entire customer base. The disadvantage is that it is a snapshot in time. If something changes in a company's credit status tomorrow, you have no idea. By the way, you can easily import the credit data into your CRM. By regularly running a batch, you keep a good eye on the creditworthiness of your customers.

API/Connector

Ideal for: companies that want to automate credit checks and have real-time visibility.

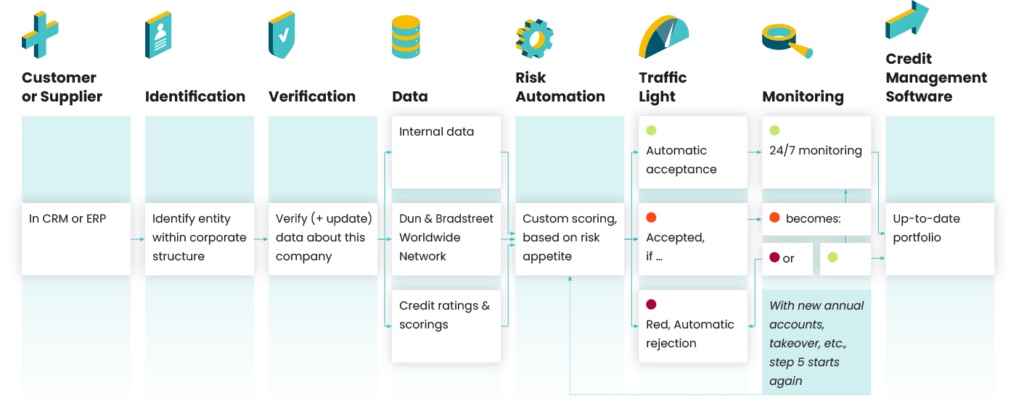

Automated credit checks are by no means the best solution for every business. But if you have many transactions with many companies, then they really are ideal. We offer both an API and connections with Salesforce and Microsoft Dynamics. You can use it to enter credit data on every company in your database in real-time. Based on that, you can fully automate credit checks. You can see how that can work in the visual below.

Simply put, you create multiple paths that companies can follow based on the credit check. For companies that are considered healthy you can offer immediate delivery ahead, while unhealthy companies follow a different path and have to make a down payment first, for example.

Do you still have questions about the different ways to use credit checks? Then contact us here. Want to know more about automated credit checks? Be sure to read this white paper.