Managed Compliance

Your KYC screening, managed

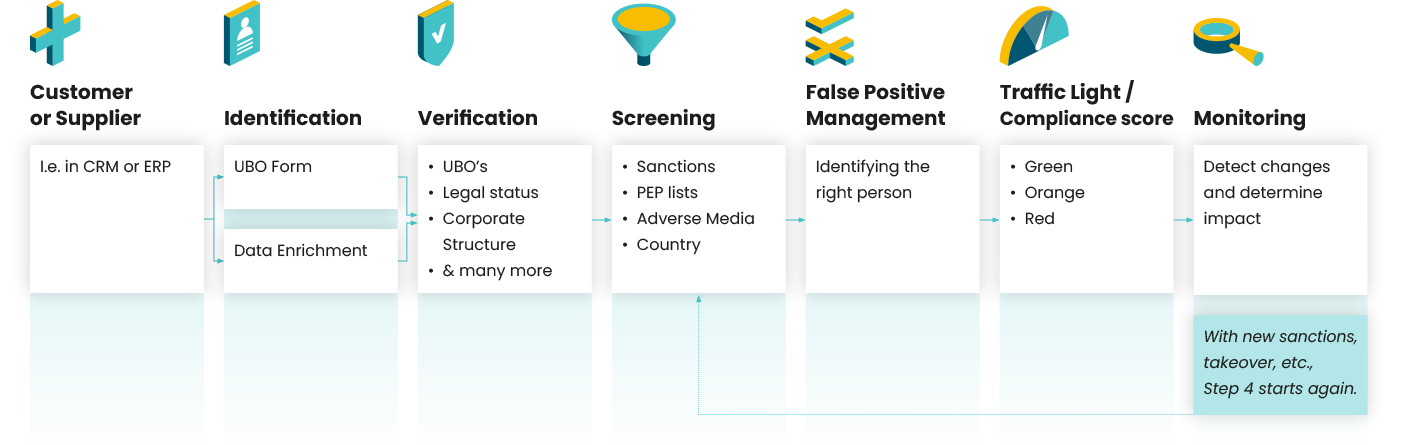

Is customer screening expensive and a specialized job? Managed Compliance does it for you: identifying, screening, monitoring, and false-positive management of customers and suppliers within one automated process.

Managed Compliance

What is Managed Compliance?

Managed Compliance is a service that identifies, screens and monitors your customers and suppliers for sanctions according to the latest international laws and regulations. The whole process happens 'under water'. For example, when a new customer signs up through your website, we screen this company and its stakeholders (UBOs) undetected and feed one compliance score back into your systems, such as an ERP.

Our customers

What does Managed Compliance do and what do you do yourself?

Managed Compliance | Self | |

|---|---|---|

Create template for email ID verification (UBO form) | – | |

Determine risk appetite (possibly in collaboration) | – | |

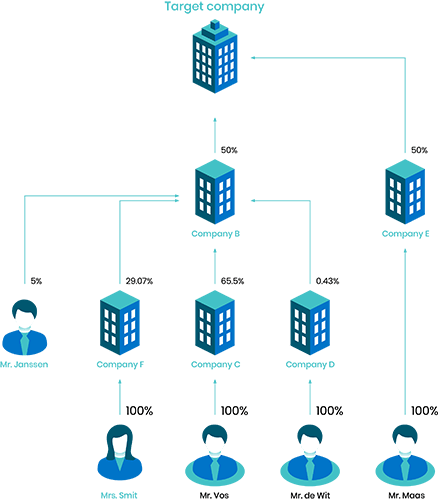

Identification of business entity, owners, shareholders, and pseudo-UBOs | – | |

Verification of legal status and activities | – | |

Determining the person(s) authorized to sign documents | – | |

Mapping ownership structure | – | |

Screen UBOs for PEP and sanctions lists, country, and adverse media | – | |

False positive management

| – | |

Monitoring inc. alerts | – | |

Investigate complex cases more deeply | – |

Global data, global screening

- 500M bedrijven

- 100M UBO’s

- 700 Watch lists

- 1.5M PEP’s

- 200 countries

Risk appetite: adjust your risk score

There are laws, such as the AML directives, that everyone must comply with, but your risk score may differ from that of other organizations. You can give more or less weight to factors that you consider important for your risk appetite, such as environmental scores and you can specify this per country.

As a result, you screen your customers and suppliers against a curated score that matches your organization's risk level.

5 Benefits of Managed Compliance

Comply with current laws and regulations

Speed up KYC checks by up to 80%

Save yourself an expensive compliance department

Automate your KYC process

Save a lot of time

Free 1-on-1 consult

Discuss the possibilities for your unique situation with a specialist from Altares.

Get immediate answers about the possibilities within your workflow.

Free. No strings attached.

"*" indicates required fields

What can we help you with?

I want to automate my customer acceptance process

For a clean, efficient and effective customer underwriting process, you need a reliable source of up-to-date business information. Integrate Dun & Bradstreet data directly into your own environment and automate your underwriting process for fast, informed and consistent decisions. Read more.

I want to assess the risks with prospects

Did a promising lead come in? Good for you! But now it's time to make some business decisions. Are you going to accept him as a customer? Can he buy on credit, and if so on what terms? When making these decisions, use our reliable business information, such as our credit risk data. Then you avoid doing business with companies that actually cannot meet their financial obligations. Read more.

I want to understand the risks of a country's business environment

Altares Dun & Bradstreet's country information informs you of everything you need to know about doing business in a specific country. You will be kept informed of important changes and of expected national developments within a country that may affect your business. Read more.

I want to monitor the developments within my debtor portfolio

By enriching your own client information with valuable Altares Dun & Bradstreet data, you create a clear overview and always know exactly how your client portfolio is doing. Where are your risks and where are your opportunities? Based on this insight you can segment your dunning process and determine focus within your portfolio. Read more.