Discover the 7 benefits of indueD

Our leading compliance solution, indueD, can help you achieve the unthinkable: manage the complexity of compliance while achieving ethical business growth. And do it all in a cost-effective way.

Our leading compliance solution, indueD, can help you achieve the unthinkable: manage the complexity of compliance while achieving ethical business growth. And do it all in a cost-effective way.

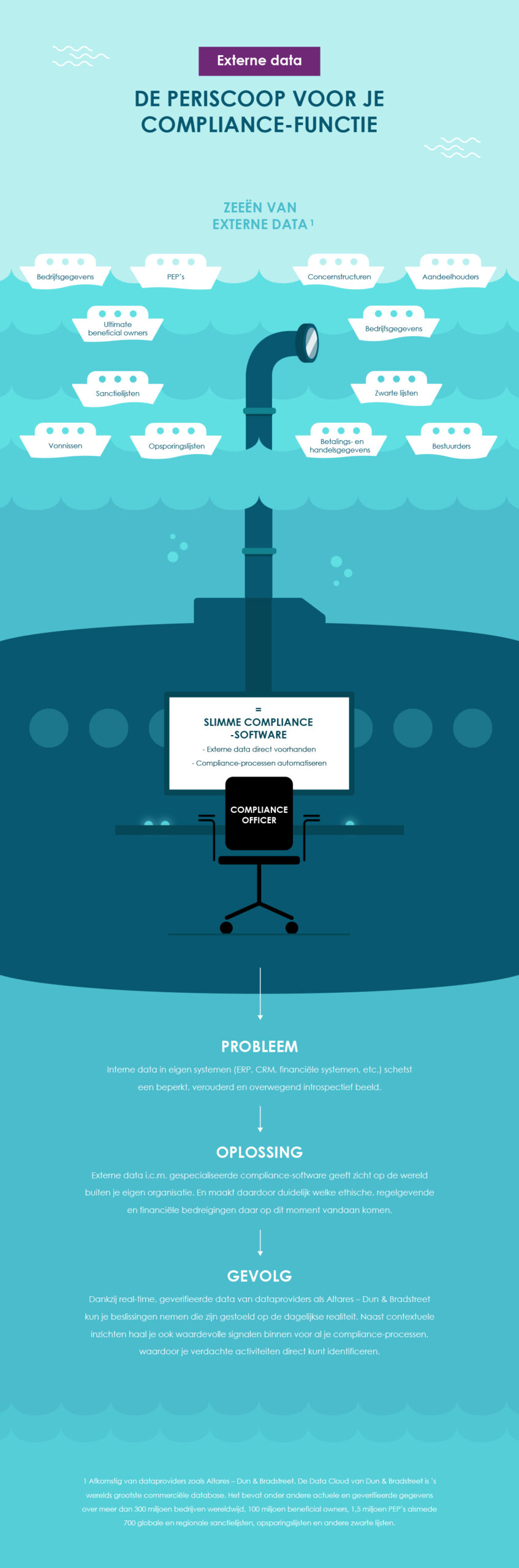

Perhaps the biggest challenge within your KYC process is determining the ultimate stakeholder - or Ultimate Beneficial Owner (UBO). How do you gain insight into an organization's entire family tree without slowing down your KYC process?

Thanks to real-time data, you can make decisions based on daily reality. In this way, you gain valuable signals for processes such as know your customer (KYC) and anti-bribery and corruption (ABAC).

How can you simultaneously facilitate business growth, achieve a more efficient compliance function, stay compliant and avoid risk? The solution is a smart combination of external data and specialized software.

Altares Dun & Bradstreet

Inter Access Park

Pontbeekstraat 4

1702 Dilbeek (Brussels)